Discharged Not Final Billed are accounts stuck between the time the patient has discharged and the time a claim is generated. Activities that occur during this time include days waiting for final charges, coding and other unique reasons not to finalize for billing. One may want to break out coding days as a subset of DNFB, as well as subtract your standard hold days.

Why is it important?

DNFB days will indicate where there are delays in finalizing data immediately post discharge. Typically there are few data edits available during this time period other than for charging and coding. One wants to move the account to the billed or claim generated status as quickly as possible to apply all the claim edits in order to identify and correct errors in a timely manner.

What’s the calculation?

Average Daily Revenue is usually based on the most recent 3 Months (90 days).

What is the benchmark?

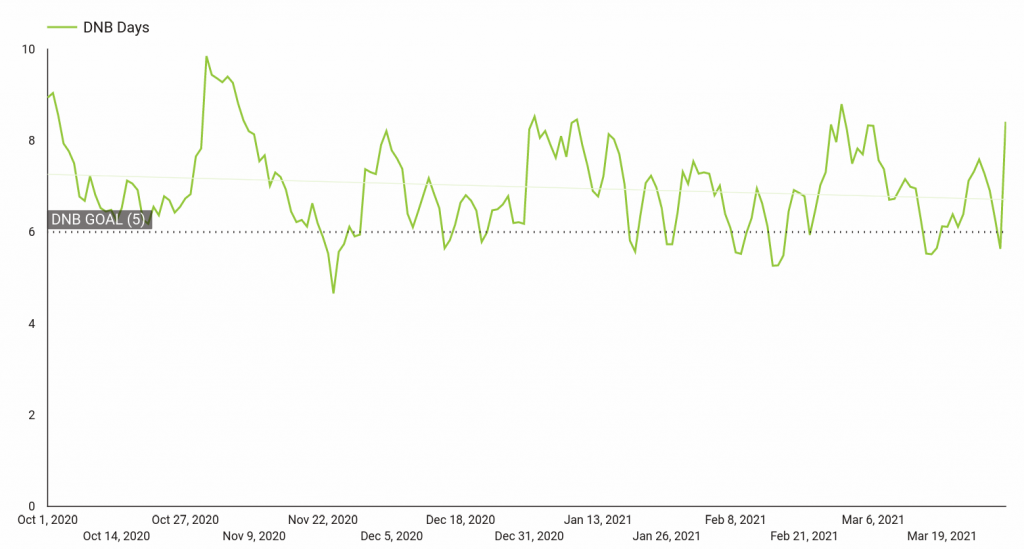

For those with automated workflows and interoperable systems, 5-7 days is typical. For those with more manual workflows, 7-9 days would be a reasonable goal.

Coding as a subset of those total DNFB days should be 2-4 days depending on the your level of automation vs. manual processes.

These benchmarks should only be suggestions. If you are able to optimize elements of your workflows that can beat these benchmarks, all the better.

How often should I update?

DNFB should be used as a daily operations indicator so you can catch as quickly as possible when the trend moves in the wrong direction and apply mitigation tactics as soon as possible just as you do with overall A/R monitoring.

Where do I get my data?

For daily tracking, your practice management system should have a report(s) that will provide total AR and daily revenue. You might get lucky and you’ll find a daily admin report that can be emailed to you each morning.

What does it look like?

What else?

The above list will become active links when the articles are available.