“I don’t have time to check insurance eligibility.”

“It slows down our throughput during busy times.”

It does take time to ask for the insurance information and I would argue, it is as important as the health history information. If we don’t collect the insurance or correct insurance, we bill the patient and cause them undue stress.

Why is it important?

Timely and accurate insurance verification is important for a great patient experience. It is also crucial to getting paid from both the benefit plan and the patient. Registration and insurance verification denials are among the most common for providers. Successful insurance verification also starts several other processes: Prior Authorizations, Price Estimates, Preservice Collections, Benefit Determination, Medical Necessity Checks, Charity Care Determination, and others.

What’s the calculation?

Total Registrations Verified

———————————————–

Total Registrations

What is the benchmark?

High performing facilities reach a >98% Eligibility Verification Rate. Or broken out between IP and OP:

- 95% outpatient

- 100% inpatient

How often should I update?

This is typically a monthly measure. One would want to increase this frequency for targeted areas where denials are higher than expected.

Where do I get my data?

One normally uses an Insurance Verification clearinghouse vendor. This system will provide the number of registrations verified, your practice management system will provide the total number of registrations.

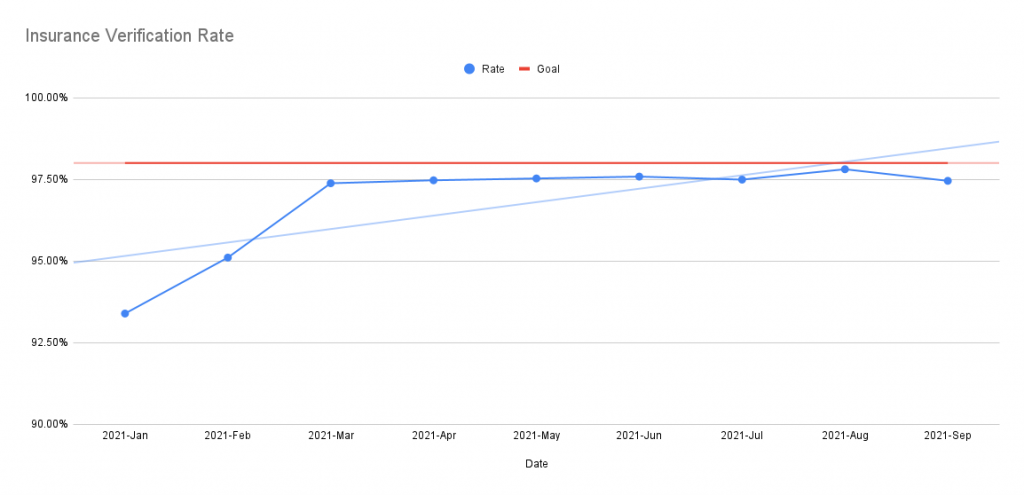

What does it look like?

What else?

- Pre-Registration Rate

- Prior Authorization Rate

The above list will become active links when the articles are available.